According to WSJ (

link), Spain has finally implemented the broader reform of the labor market structure. Spain's 20 percent unemployment rate is the highest in the Euroarea. Traditionally, Spain was known for its notorious and heavily regulated labor market. The country used to maintain high levels of minimum wage and high cost of dismissal. The reform introduced by the Zapatero government removed the restrictions for dismissals on a fair basis and deregulated dismissal procedures on indefinite labor contracts. Dismissal cost has been decreased from 45 days to 33 days of salary per year worked.

The labor reform in Spain led to a lot of controversy among economists. Dani Rodrik (

link), for instance, claims that labor market deregulation and fewer firing restrictions will further increase the unemployment rate since the major cause of it is the lack of labor demand. On the other hand, a handful of economists claim that Spain's persistent labor market rigidities are the major cause of country's high unemployment rate.

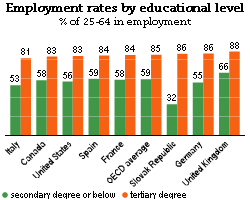

According to World Bank, redundancy cost in Spain averages 56 weeks of wages, more than twice the OECD level. During recessions, the decline in labor demand usually increases the unemployment rate and, therefore, hiring and firing restrictions do not exert the major influence on firm's decisions to employ additional units of labor. However, the persistence of strong labor market regulation imposes significant economic costs.

First, firms do not employ the optimum amount of labor. High redundancy cost and rigid dismissal procedures lead to either under-employment or over-employment of labor. Thus, firms shift the burden of high labor cost on higher prices, lower dividends and lower net wages.

Second, labor market regulation has broader implications. It eventually leads to more institutional rigidities and more pressure on higher wages by trade unions through collective bargaining. Consequently, wages become downward rigid. During the economic recovery, firms are therefore less motivated to employ new workers or extend the existing labor contracts.

As Spain finally recovered from the recession, the ongoing labor rigidity and even the increasing labor demand could not alleviate Spain's high unemployment rate. It would only put more pressure on Spain's government to increase government spending on unemployment schemes. Therefore, the reform of the labor law based on labor market flexibility is the most plausible alternative for Spain to boost employment and decrease the widening budget deficit that threatens country's economic recovery.